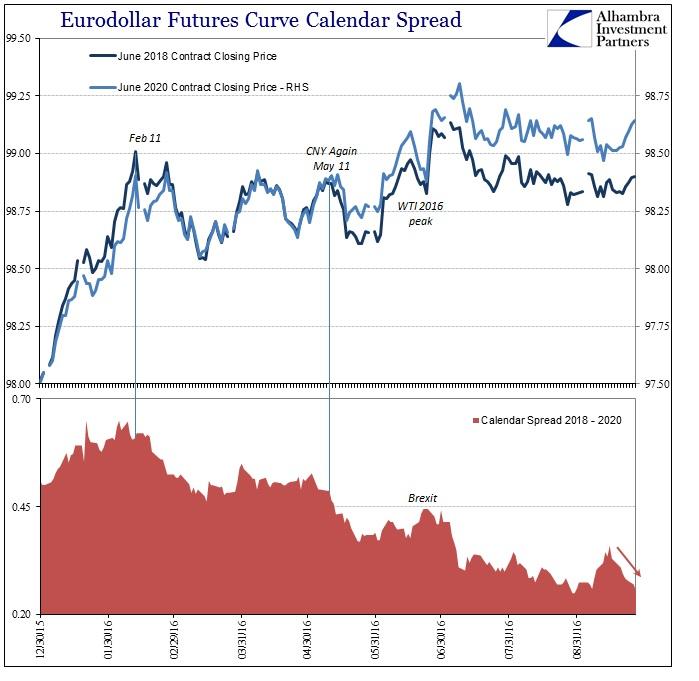

Eurodollar Calendar Spread Options - Trading Calendar Spreads Learn the Strategy, Roll De… Ticker Tape, Eurodollar trading volume is exploding, with no end in sight tools phenomenal growth. A calendar spread is an options or futures spread established by simultaneously entering a long and short position on the same underlying. Pin on CALENDAR SPREADS OPTIONS, Find the price of the forward note. I'm interested in the pricing of a a cso (calender spread option) as defined by cme group.

Trading Calendar Spreads Learn the Strategy, Roll De… Ticker Tape, Eurodollar trading volume is exploding, with no end in sight tools phenomenal growth. A calendar spread is an options or futures spread established by simultaneously entering a long and short position on the same underlying.

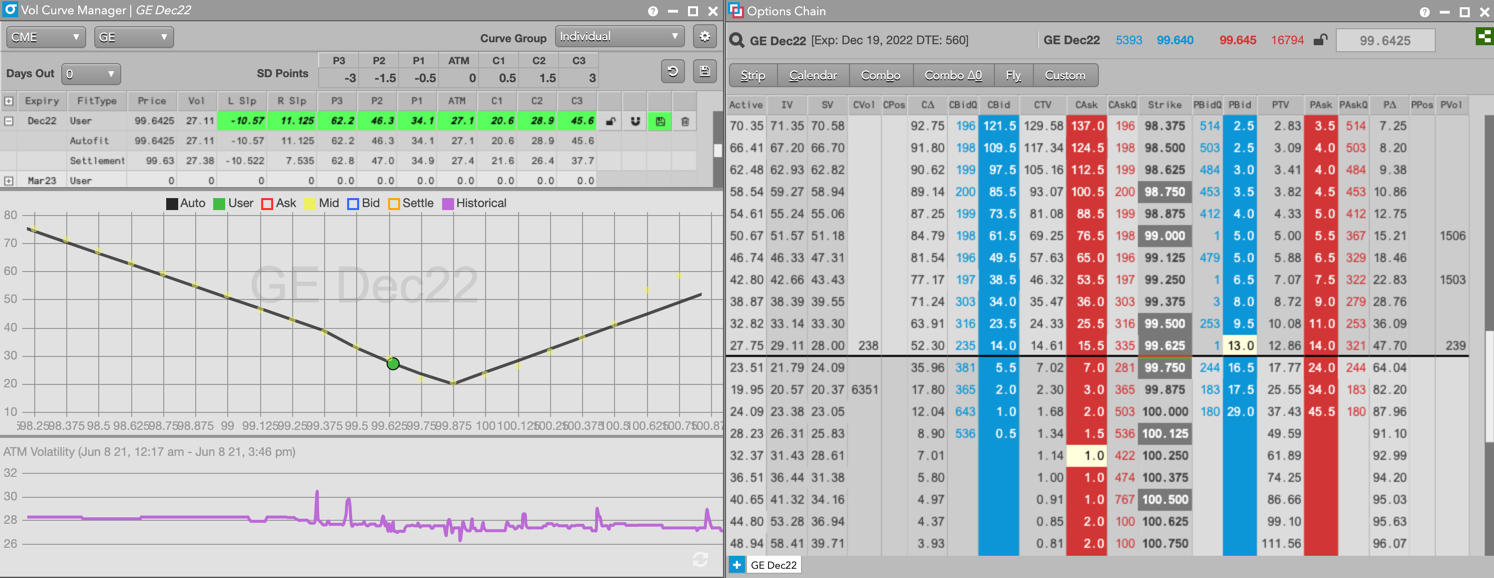

You’ll find the closing price, open,. From june 30, 2023, eurodollar exposure dated beyond that date will automatically convert to cme sofr futures with a defined spread.

No Need For Yield Curve Inversion, There Is Already Much Worse, The eurodollar futures and options handbook provides traders. One example would be the buying the march 2025 eurodollar futures contract and selling the march 2025 eurodollar futures contract.

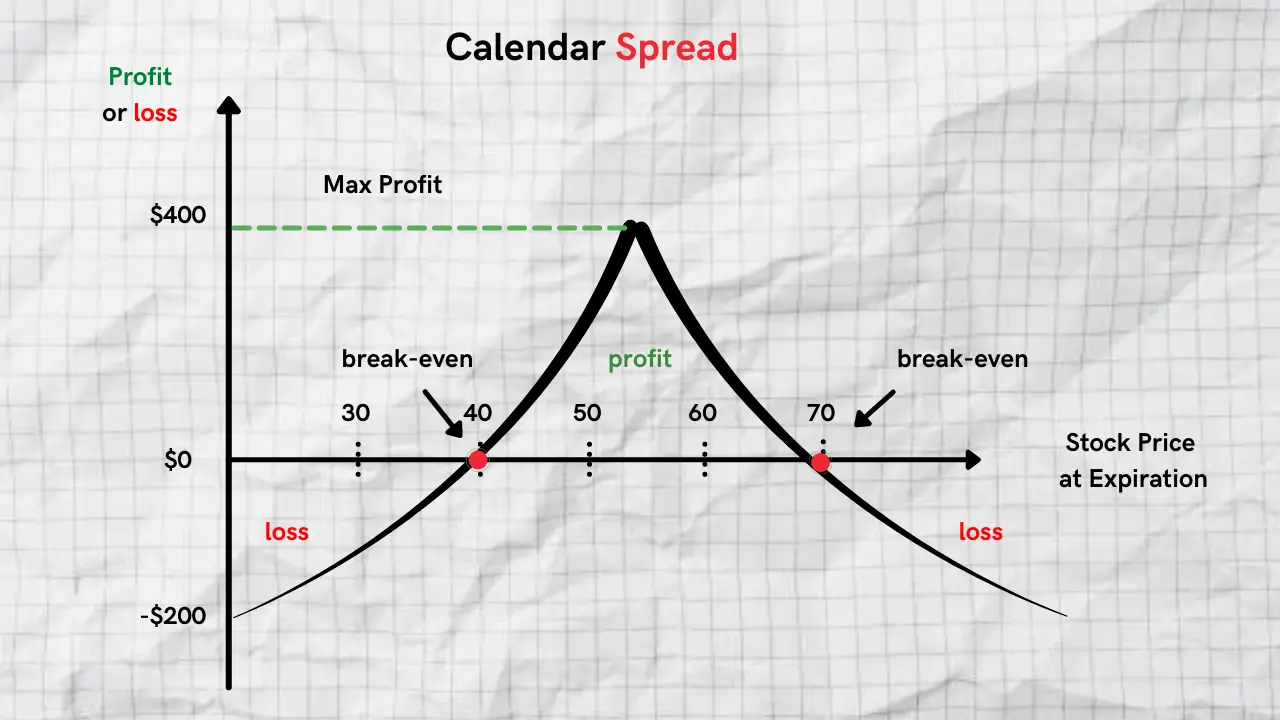

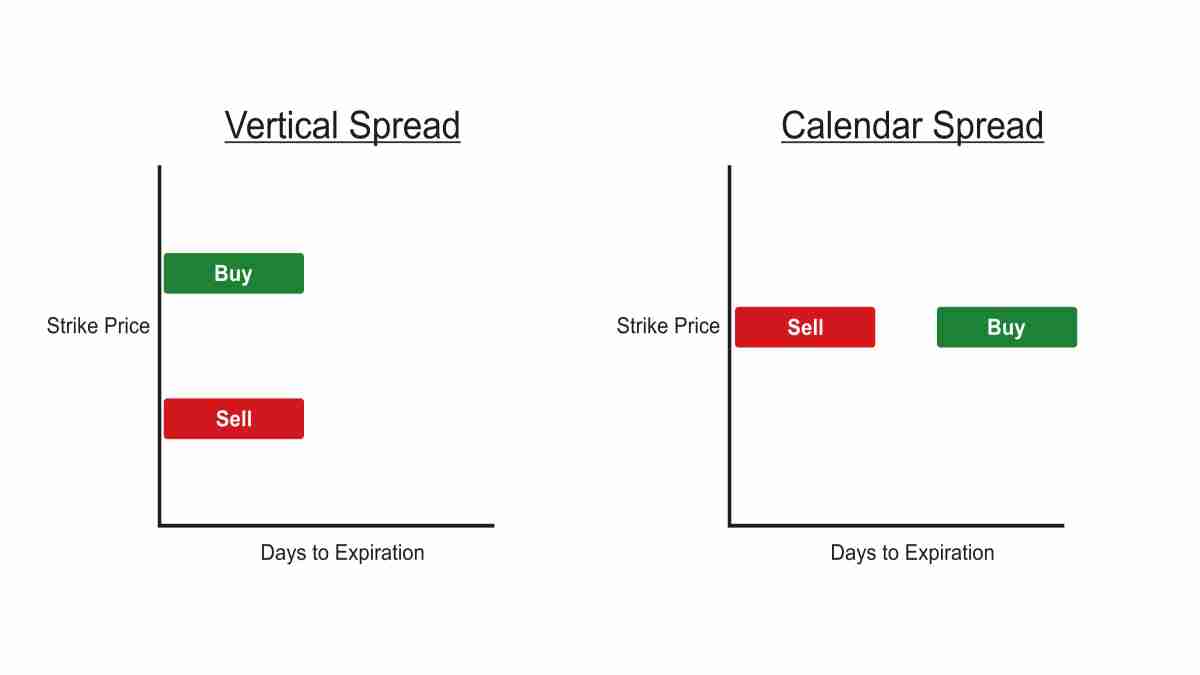

A calendar spread is an option spread established by simultaneously entering a long and short position on the same underlying.

Calendar Spread Explained InvestingFuse, A calendar spread is an option spread established by simultaneously entering a long and short position on the same underlying. Since the value of one basis point is $25 in all the quarterly.

These options are scheduled to launch on sunday, august 17, 2008,.

A calendar spread is an options or futures spread established by simultaneously entering a long and short position on the same underlying.

Eurodollar Calendar Spread Options. From june 30, 2023, eurodollar exposure dated beyond that date will automatically convert to cme sofr futures with a defined spread. That large user base consists of traders, asset liability managers, interest rate hedgers and spread traders.

Two New Reasons to Trade Options on TT® Eurodollar Options and, Futures option prices for eurodollar (pit) with option quotes and option chains. That large user base consists of traders, asset liability managers, interest rate hedgers and spread traders.

スプレッド取引とは スプレッド取引戦略 IFCM ジャパン, A calendar spread is a spread trade involving the simultaneous purchase of futures or options. One example would be the buying the march 2025 eurodollar futures contract and selling the march 2025 eurodollar futures contract.

FX and Fixed trading Eurodollar futures, examples and, Following their definition, the payout of the option at. A calendar spread is an option spread established by simultaneously entering a long and short position on the same underlying.